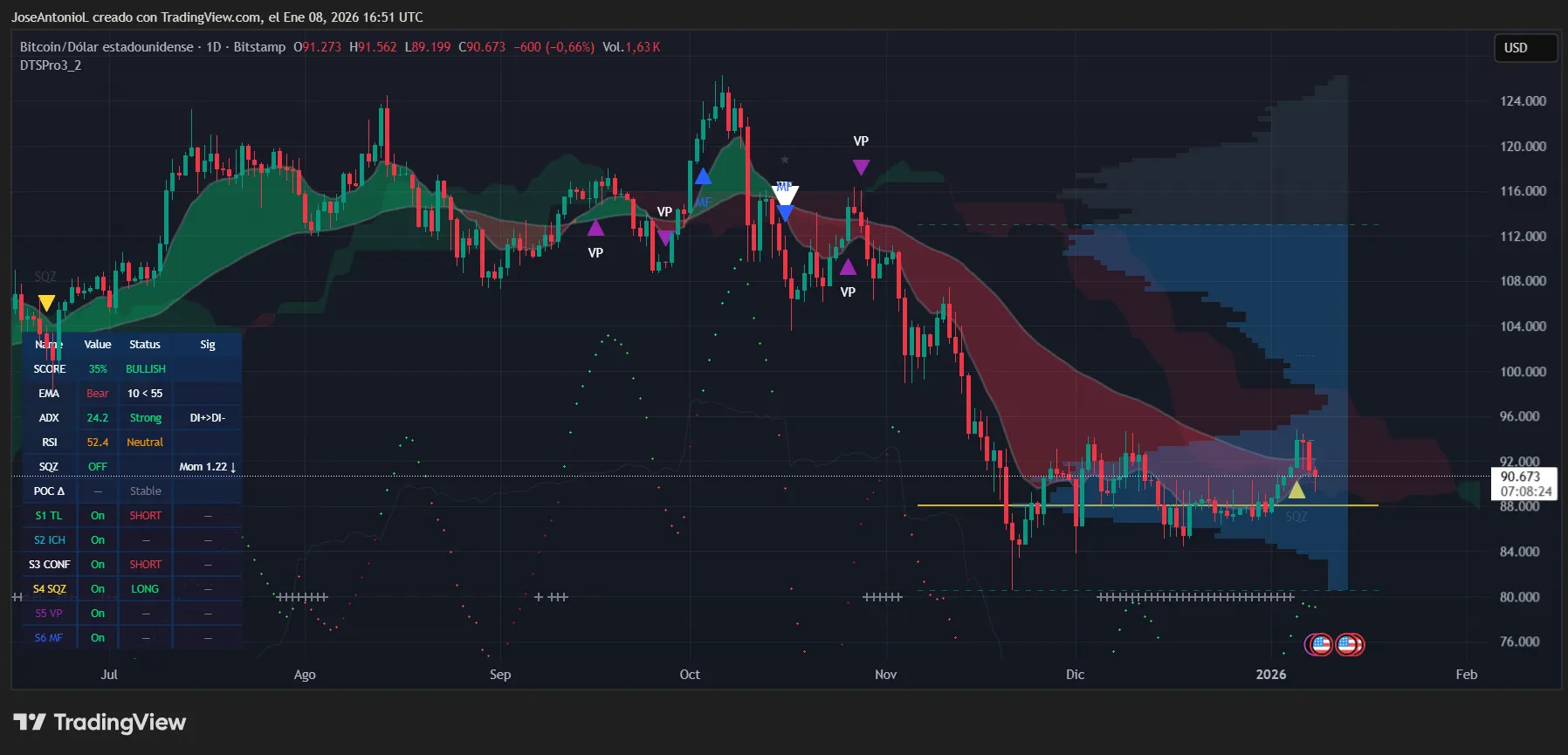

The post-New Year rally fizzled fast. Bitcoin is back in death cross territory, and the charts aren't giving bulls much to celebrate.

Bitcoin is back above $90,000 on Thursday afternoon as crypto markets look to digest their early-year gains. Coinglass data shows 132,723 traders were liquidated in the past 24 hours for $455.54 million. In the past 24 hours, top gainers include JasmyCoin, Bittensor and Lighter.

Stablecoins did not become a global settlement layer because banks adopted them. They grew because businesses and fintechs needed faster settlement, predictable fees, and global money movement that legacy payment rails could not provide.

Florida lawmakers introduced another bill for the creation of a strategic Bitcoin reserve, less than a year after two attempts were shelved.

Morgan Stanley ( NYSE:MS ) on Thursday announced plans to launch a digital wallet in the second half of 2026, expanding its push into digital assets and blockchain-based financial infrastructure.

The transaction would give the Japanese exchange operator control of the Canadian asset manager, expanding its presence in regulated investment products.

BlackRock adds $900 million in Bitcoin as long-term holder selling drops to 2017 lows, pointing to early signs of BTC accumulation.

BlackRock Inc. ( NYSE:BLK ) U.S. head of equity ETFs Jay Jacobs on Wednesday said that despite billions in inflows, crypto ETFs remain in their early days as financial advisors only recently gained platform access.

In the latest Cointelegraph video, we break down the 2026 Bitcoin forecasts from top crypto companies and the trends shaping the market ahead.

Binance's U.S. expansion could be a threat, the bank warned while upgrading Coinbase to a "Buy" rating.

Amsterdam, the Netherlands - Flow Traders Ltd. ( Euronext: FLOW ) publishes the 4Q 2025 pre-close call script to be used with analysts post the market close on 8 January 2026. Welcome to the Flow Traders 4Q 2025 pre-close call, which is being conducted post the ...

MSTR gets a lift after MSCI pauses plans to exclude digital-asset holders from indexes, easing a key near-term risk for the stock.